Hi everyone! It’s Tom from pancake analytics and it’s been awhile but I proud to bring you a fresh stack of of analysis. Today’s analysis is on the Pokémon Trading Card Market, the recent boom, it’s decline and how we use the historic sales data to evaluate sets and cards we love to collect moving forward.

The boom of October 2020 was actually hinted at in January 2019 by forbes.com in their article titled “Trading Cards Continue to Trounce the S&P 5– As alternative Investments”. A line from this particular article which I find eye opening is:

“If a decade ago you had put your money in vintage and modern trading cards instead of the stock market, your payoff would be more than twice as big.”

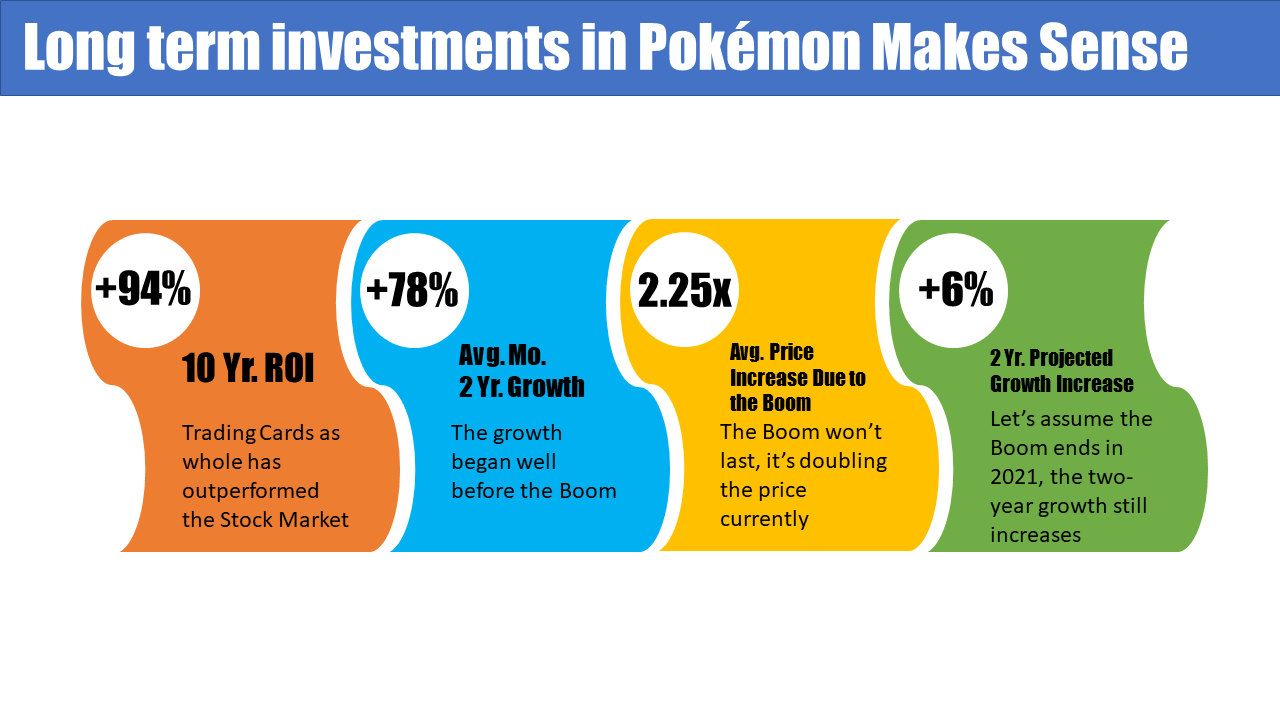

A few more eye opening statistics from this article, the difference between the PWCC Top 500 Index 10 Year ROI and the S&P 10 Year ROI is 94%. That’s where our twice as big takeaway comes.

What is the reason behind this? Well maybe people have a deeper emotional connection to Charizard than they do to Amazon shares.

I’ve sourced Pokemon graded cards data from a site I recommend everyone visit: Pokemonprice.com.

Using this data and trending it over time here’s what I’m able to conclude from this analysis:

Regardless of the “Boom”, vintage cards grow. Let’s analyze the base set 1st edition non holo sales to explain this statement.

The average monthly two-growth of this set is 78% (excluding the boom data) and this is on par with last year’s two-year growth (2019 vs 2017) of 80%.

Pokémon Cards have shown a steady growth over time inline with the rest of the trading card industry. Although the monthly increase has declined by 7%, this speaks more to purchasing power of the market. Not everyone can afford to purchase a thousand-dollar card.

How much did the boom affect the sales? Looking at the total sales over time the boom begins in April 2020 there is a 98% increase in the total sold value of this set. Previously there was an increase of 45% in 2017, and 22% in 2018. In other words it doubled the growth, in a short period of time, this was never going to be sustainable.

We can learn and project sales from our data. The approach I’ll use is a holt-winters time series model. This approach works particularly well with sales data and especially if there’s a seasonal aspect ( i.e. high sales volumes over Christmas ).

A holt-winters uses three factors, a trend, a typical value and a cyclical repeating pattern. A trend is a slope over time, think what is our monthly change in sales? The typical value is used to add a value to recent sales, in this case I’ll use the average sale. Finally for the cyclical repeating pattern, which is a drawn out way to say seasonality, I’ll use our monthly sales figures.

We have our forecast built and it works, some might say it’s super effective, statistically it’s excellent. Mean Average Percent Error (also known as MAPE) will be our definition of success for this model, which stands at 8% . Anything below 10% is considered an excellent forecast and this is out of sample.

What I mean when I say out of sample, is I used historic data to predict values I already know occurred. This is best practice when building a forecast, please train and test your models.

The forecast has an excellent MAPE even with the boom occurring. The orange line is our forecast, and the blue line is the actual sales. I’m not confident the boom will be sustainable. You can see our forecast predicts sales which more align with the yearly growth I’ve mentioned previously. ( See the images below for the forecast lines )

The boom won’t last, but the two-year growth continues, this is promising for long term investing in Pokémon trading cards.

I’ll show two scenarios, the first scenario being the most unlikely which is the “Boom” is the new norm.

If the “Boom” is sustainable, the average growth in sales per card year over year, 2021 vs 2020, is more than double, 2.25 times more.

This average growth is $251 usd, which is roughly the equivalent of two modern booster boxes at retail price.

Now for the most likely scenario, the “Boom” ends.

If the “Boom” ends in early 2021 the market will be down year over year by 38%. There’s a bright side, this would still be an 84% growth compared to two year ago (2021 vs 2019). The average two growth would increase by 6%, still outpacing the stock market ( as called out by forbes.com in 2019 ).

Our forecast can be used to evaluate individual sets, this is were the fun of collecting what you love meets data science.

To show this application I’ve evaluated 3 sets which I feel are different from each other (variants, anime characters, etc.):

Jungle 1st Edition Holos

Gym Heroes Unlimted

Neo Genesis 1st Edition

Using the model I built and applying it to the individual sets here’s my evaluation and reccomendation:

Jungle 1st edition holos will show a growth of around 2.6x, that’s an increase of roughly $12K for the entire set value, by the end of December 2021.

Gym Heroes Unlimited non holos will show a growth of around 1.5x, that’s an increase of roughly $1.3K for the entire set value, by the end of December 2021.

Neo Genesis 1st Edition non holos will show a growth of around 2.8x, that’s an increase of roughly $39K for the entire set value, by the end of December 2021.

First glance you would think to yourself well, let invest in the Neo Genesis 1st Edition cards and forget the rest. I wouldn’t agree with you 100% if that’s what you want to do, I agree with you 100% if the first game you played in the series was gold/silver. Reason being is you have an emotional attachment to the Pokémon in that game, you are progressing your career/personal life to be able to invest in trading cards, so there will be more individuals like you, the market is there.

I will say don’t collect something you are not a subject material expert on and don’t collect something that the market isn’t there.

When I see these three sets compared to each other, I actually prefer Gym Heroes as an investment. The growth is there, you can argue it’s more sustainable because it’s only a $1K increase, and I personally feel the emotional attachment to gym leaders goes beyond the main series of video games, it leaks into the anime, cosplay at comic cons, and even some of the mobile apps (think Pokémon masters). Also from an ROI standpoint, you can acquire a lot of great cards from this set right now for a very low investment.

Long term investments in Pokémon Makes Sense. Trading cards as whole have outperformed the stock market over the past 10 years. The growth began well before the “Boom”, you can see this begin in 2018, and stay through 2019. The “Boom” won’t last, it’s currently doubling the price of cards. Let’s assume the “Boom” ends early 2021, the two-year growth still increases.

If you have time to invest, and can wait for a 10 year return, I’d recommend you do.

Leave a Reply